The Brand Group Core delivered strong monetary ends in 2023. Higher quantity and value results, improved availability of elements and decrease mounted prices had a constructive impact, whereas larger product prices and the deconsolidation of Volkswagen Group Rus had a damaging affect on the end result. The world market and aggressive atmosphere stays difficult. The Brand Group Core is engaged on additional stabilizing its efficiency with a view to enhancing its resilience in opposition to exterior components, specifically given the slower growth of the e-mobility market in Europe.

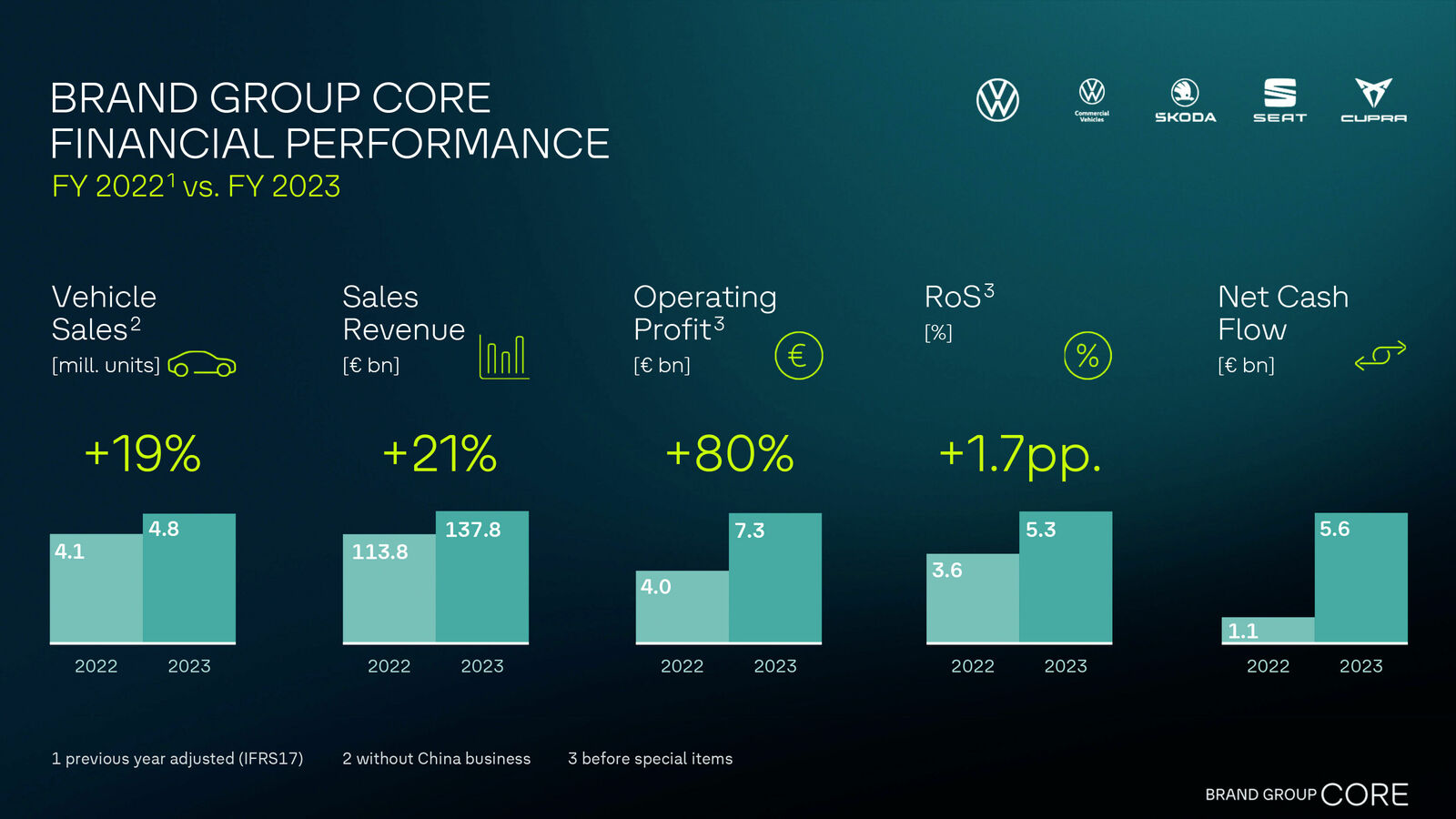

The systematic growth of cooperation within the agreed cross-brand core motion areas is having a sustained constructive impact on key monetary efficiency indicators: Brand Group Core working revenue earlier than particular objects in 2023 grew 80% year-on-year to 7.3 billion euros (2022: 4.1 billion euros). The essential driver right here was a 19% enhance in unit gross sales to 4.826 million autos (2022: 4.069 million autos). Net money move elevated from 1.1 billion euros in 2022 to five.6 billion euros. This growth was mainly attributable to the one-off discount of inventories that largely corrected the stock build-up because of the scarcity of logistics assets within the earlier 12 months. The working return earlier than particular objects improved by 1.7 share factors to five.3% (2022: 3.6%), gross sales income climbed 21% to 138 billion euros (2022: 114 billion euros).

Thomas Schäfer, Member of the Board of Management of Volkswagen AG, Head of the Brand Group Core & CEO of the Volkswagen Passenger Cars Brand, stated: “The closer cooperation in the Brand Group Core is gaining traction. Our work is beginning to pay off. Our networking has become stronger and more systematic. We now have several projects where cooperation extends beyond former brand boundaries. We have the right team spirit. As the volume brands’ CEO team, we have pushed hard to drive this transformation forward in recent months. Our common goal: to fully exploit our performance potential as a brand group by sharing knowledge and working together to find the best solutions. With our strong, clearly differentiated models we ideally cover important market segments without cannibalizing business for our sister brands. And our networking will become ever closer in order to leverage our enormous combined potential even more effectively in future under difficult economic conditions and within a rapidly changing automotive industry. That is good for each brand, for the Group and for our customers.”

Key figures for the Brand Group Core:

|

Key financials |

2023 |

2022 |

Change 23/22 |

|

Unit gross sales |

4,826,276 autos |

4,069,342 autos |

+19% |

|

Sales income |

137.770 billion euros |

113.762 billion euros |

+21% |

|

Operating revenue earlier than particular objects |

7.273 billion euros |

4.045 billion euros |

+80% |

|

Operating return earlier than particular objects |

5.3% |

3.6% |

+1.7%-points |

|

Net money move |

5.625 billion euros |

1.131 billion euros |

All the person manufacturers Volkswagen, Škoda, SEAT/CUPRA and Volkswagen Commercial Vehicles contributed to the constructive total efficiency of the Brand Group Core – and thus additionally the Volkswagen Group – within the 2023 fiscal 12 months.

Unit gross sales on the Volkswagen model grew by 13% to 2,519 million autos (2022: 2,236 million autos) within the 2023 fiscal 12 months. The model’s gross sales income climbed to 86,4 billion euros (2022: 73,8 billion euros). The essential drivers right here have been the license enterprise with China and a powerful efficiency in after-sales enterprise. The working revenue earlier than particular objects of three.5 billion euros (2022: 2.6 billion euros) additionally mirrors the brand new give attention to effectivity and profitability. At 4.1%, the working return earlier than particular objects was 0.5 share factors above the determine for the earlier 12 months (2022: 3.6%). The improved working end in 2023 exhibits that the model is strengthening its resilience and enhancing its competitiveness. Given the growing depth of competitors worldwide and the related monumental stress on costs and prices, the efficiency program agreed final December will contribute to stabilizing the return on gross sales trajectory from 2024. The Volkswagen model is thus laying the groundwork to strengthen resilience in a persistently difficult market atmosphere.

Patrik A. Mayer, Member of the Board of Management of the Volkswagen Brand liable for “Finance”, commented: “The solid results for the 2023 fiscal year show we are becoming more financially robust. Volkswagen is the Group’s core brand and we must live up to our responsibility – with good products, and also with good figures. Systematically implementing our Accelerate Forward performance program will make us significantly more effective and faster by 2026: not only in our factories and in development, but also in administration and sales. We therefore believe we are well prepared for a demanding year in 2024 with its muted economic outlook.”

Škoda Auto additionally reported a profitable 2023 fiscal 12 months. Global unit gross sales by Škoda Auto final 12 months ran at 866,800 autos (+18,5%), with the all-electric Enyaq recording the very best progress (81,700 autos bought; +52%). The all-electric mannequin was one of many best-selling electrical autos in lots of European markets. The Škoda Auto Group reported report gross sales income of 26.5 billion euros in 2023 (2022: 21,0 billion euros; +26,2 %). The model’s working revenue earlier than particular objects got here in at 1.8 billion euros, 183% larger than the prior-year degree (2022: 0.63 billion euros).

At 6.7%, the working return earlier than particular objects was effectively above the extent of the earlier 12 months (2022: 3.0 %). These sturdy outcomes underpin the corporate’s strong enterprise mannequin for making the mandatory investments within the ongoing transformation to e-mobility.

SEAT/CUPRA placed on a convincing efficiency final 12 months with a marked 28% rise in unit gross sales to 602,000 autos (2022: 468,000 autos). The model reported 31% progress in gross sales income to 14,3 billion euros (2022: 10,9 billion euros). Operating revenue earlier than particular objects ran at 625 million euros, effectively up on the earlier 12 months’s determine of 33 million euros. The group-wide enhance in profitability is clearly seen: the working return earlier than particular objects rose to 4.4% (2022: 0.3%). This is mainly attributable to the success of CUPRA with larger unit gross sales and constructive results from effectivity enhancements.

Business growth on the Volkswagen Commercial Vehicles (VWN) model was additionally constructive: unit gross sales elevated by some 25% to 423,000 autos (2022: 340,000 autos) and gross sales income grew 34% to fifteen billion euros (2022: 11 billion euros). Furthermore, there was a 65% rise in working revenue earlier than particular objects to 873 million euros (2022: 529 million euros). Progress with driving profitability was confirmed by a rise within the working return earlier than particular objects to five.7%, in comparison with 4.6% within the earlier 12 months. This report efficiency is attributable to the model’s strong positioning. Vehicles for personal and industrial clients, the enduring ID.Buzz and the distinctive California fashions fulfill particular person buyer needs. This efficiency was achieved by the systematic implementation of the effectivity program at VWN and the related price self-discipline.

Outlook

The Brand Group Core plans to extend its end in 2024, bolstered by the associated results from the amount manufacturers’ ongoing efficiency packages.

Overall, the Brand Group Core continues to focus on an working return of 8% in 2026. Improved cooperation among the many sister manufacturers is predicted to leverage synergy and scale results and contribute to attaining this goal. This contains optimizing product prices, decreasing overheads below the assorted efficiency packages in place on the particular person manufacturers, and thereby safeguarding sustainable progress. In addition, the Brand Group Core plans additional quantity progress on account of the improved provide state of affairs for vital uncooked supplies and elements. Further progress in key areas (e.g. North America) in addition to the event of latest markets (e.g. Škoda Auto / Vietnam) are anticipated to have a constructive impact on return. The present fiscal 12 months will likely be formed by sturdy competitors, political challenges and the mandatory investments for the longer term. Clear-cut tasks and a task-sharing strategy kind the premise for the sturdy cooperation that can proceed to drive the success of the Brand Group and your complete Volkswagen Group in future.

Organizational observe:

Škoda Annual Press ConferenceFriday, March 15, 10:00 a.m.

VWN Annual Press ConferenceThursday, March 21, 09:00 a.m.

SEAT/CUPRA Annual Press Conference Thursday, March 21, 11:00 a.m.